D is for Depreciation

Depreciation: A gradual reduction of an asset over its useful life.

Depreciation helps businesses determine how assets assisted the company in earning revenue.

Assets in a company considered depreciable property must follow guidelines set by the Internal Revenue Service (IRS). They must be: owned by the business, have a useful life of over one year, and use the asset for income earning activities and/or be necessary for the operation of the business. Assets that don’t lose value, are personal property, or are for investment purposes are not considered in this. Did you buy a business van? A computer for your new office? That counts! Do you have a bond or stock? Land? Collectible art? Those… don’t count.

Businesses, every year, account for the depreciation by using formulas to account for market changes, wear and tear, and use. Calculating the depreciation of physical assets accounts for the amount of tax that will be paid to the IRS.

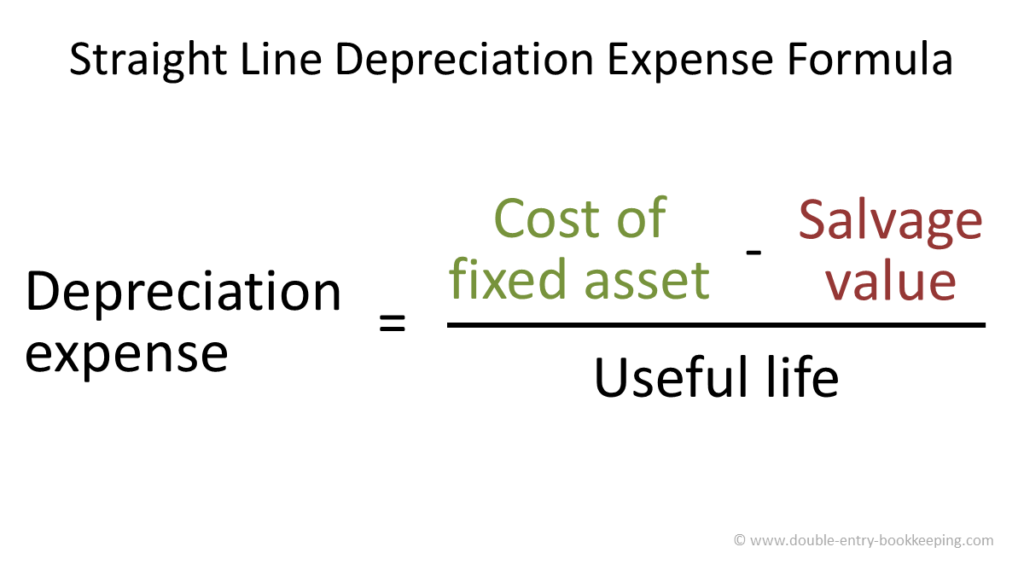

Accountants generally use straight line depreciation, calculated by an easy formula.

The formula shown includes the fixed cost of an asset, being the purchase price, as well as the salvage value being how much the asset could be sold for. The useful life is the amount of time a company expects to use the item in question for generating revenue. Other methods and formulas can change tax expenses or alter profits when used. Determining which depreciation method to use is dependent on how the asset benefits the company, how the asset is used, as well as how long the life of that asset will be.

A few paragraphs isn’t enough to fully understand how depreciation affects your business and what assets can be listed. Do you know when you bought that company vehicle? Have the papers to confirm the cost of the vehicle? Sitting down with Erin can help gather information and tax plan before the next tax season. Let’s decide what is best for you and your business to prevent you scrambling for important documents come tax season.